As a result of the personalized approach, there is no standardized price and no way to estimate the cost of root auto insurance without a test drive. The company advertises that customers can save up to $900 a year.

or

Instead, Root calculates fares primarily based on driver performance, while the app monitors driver behavior. Demographics and credibility are important, but not as much as with standard auto cover businesses.

Insurance companies such as Root deny coverage to those who do poorly on the driving test. This keeps fees low for the pool of qualified drivers. In addition, the company has committed to eliminating the use of credit scores from its pricing model by 2025 so that safe drivers are not penalized for factors beyond their control.

How Do I Get Root Insurance?

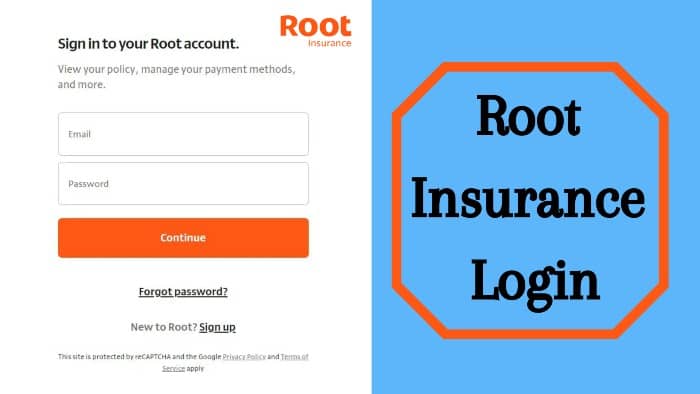

To access the Root Auto Insurance Login Portal, you must first register with Root Insurance Customer Service. Here are the steps to create a Root Car Insurance account:

- Visit the Root Insurance official website at www.joinroot.com and go to the Root Insurance login page.

- There you will see the message “New to Root? Login” Click on it.

- You are required to provide certain personal information such as your last name, first name, date of birth, email address, postal address, etc.

- After that, set security questions and passwords for your secure auto Root Insurance login account and follow the instructions.

You can also check the following:

- Interactive login for investors

- connection

- connection

- Web Watcher Login

- Intermountain bill payment login

- Greater mobile connection

- Connection with Nicor Gas

- Enrollment for Mce Insurance

- Root insurance login requirements

- Root Car Insurance Login Web Address

- Root Insurance Login Valid email address and password.

- Internet browser that supports the Root Car Insurance login portal.

- Laptop, PC, smartphone, or tablet with reliable internet access.

Login Procedure To Be Followed

Below is a step by step guide on how to log into your Root Insurance login account:

- Visit the official Root Car Insurance website at www.joinroot.com.

- In the main menu, you will see the “Connection” option. Click on it.

- You will be redirected to the Root Car Insurance login page.

- Here you need to enter your email address associated with your secure root account and your password.

- After entering your credentials, click the “Next” button to log into your root account.

Benefits Of The Insurance Portal

- Offers combined plans and discounts of up to 20%.

- Provide drivers with a personal account manager.

- It offers additional insurance benefits like DUI and more.

- Award-winning teams of customer service teams for 24/7 support.

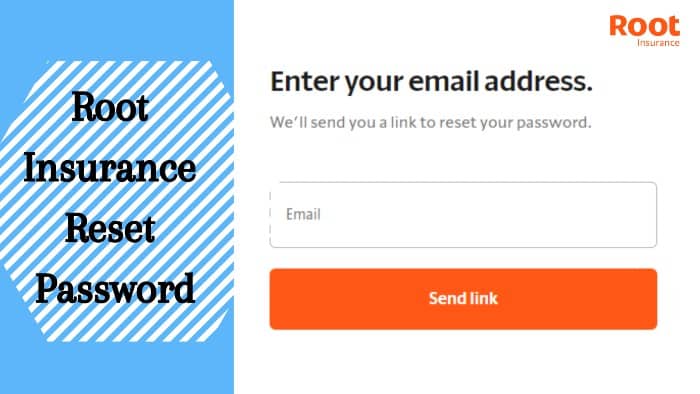

How To Reset The Root Secure Login Password?

Forgot your secure root login password? If so, the following guide will help you to recover your secure root password:

- Visit the official Root Insurance website at www.joinroot.com.

- In the menu, click on the Connect option.

- You will be redirected to the secure root login web page.

- Click on “Forgot your password?” for assistance.

- After that, you need to enter your associated email address.

- Root Car Insurance will send a link to your email address to reset your password.

- Go to the link and set your new password for your secure root account.

How Does Root Auto Insurance Work?

Like many telematics or usage-based insurance plans, Root sets its rates based on how you drive. First, demonstrate your driving skills with a test drive using the app, which tracks your driving habits over a period of weeks. You will receive a fee based on the quantity and quality of your tour.

Using your smartphone’s accelerometer and GPS, the root app calculates your speed, mileage, driving hours, and braking distance.

While factors such as age and marital status are taken into account, your driving score carries more weight than traditional car insurance companies. Safe, low-mileage drivers often report that switching to Root Insurance Customer Service saves a lot of money.

Information About Mobile App

Root rewards good drivers with cheaper fares. With the Root Car Insurance app, drivers create an account, and the app tracks their driving during a test drive and scores based on the following factors:

- braking habits

- changing habits

- Safe use of the phone

- Walk at safe times

When you install the Root Car Insurance app on your smartphone, and you have location permissions enabled, it will still track your trip; You don’t need to log in to the app or website for this to work. Using machine learning algorithms, the app also knows if you’re driving, cycling, or a passenger on a plane, subway, or car, so Root doesn’t include these rides in your trip score. Users can view their results in the root app to see how the company measures their progress.

It usually takes three weeks to complete the test drive and obtain a Root Insurance Quote from Root. When you decide to cancel your old insurance policy and join Root, you can use the app to ask Root to report your old insurance company on your behalf.

Root also offers a program called RootReady that allows drivers of certain types of cars to use previously collected driving data instead of a test drive. GM cars purchased after 2015 already collect information about driving habits that can be used to set a rate using Root Insurance Quote telematics.

You can also add other controllers to your root policy through the Root insurance App. You don’t need to test drive it, but Root encourages you to. Without the test drive, Root has to rely on standard location and demographic data to set rates and cannot offer discounts to other drivers for safe driving.

| Official Name | Root Insurance |

|---|---|

| Portal Type | Login Portal |

| Managed By | Root Inc. |

| Services | Provides Insurance |

| Country | USA |

Root Insurance Payments

Root Insurance Quote policies have a term of six months and drivers have the option of paying all of their car insurance in one go or in monthly installments. Payments are made through the app and policyholders can use credit cards or Apple Pay. The application also includes your proof of insurance, but the company will also send you a separate insurance card.

If you choose to pay in installments, select a payment date in the app. You can also change your payment frequency between monthly and full in the app.

Increase Root Rate

After six months, your Root Car Insurance premium may increase to the next term of the policy. While the main factor that determines your rate is how you drive, other factors play a role and can cause your rate to increase. These factors may include:

- Drivers listed on your policy

- The cars listed on your policy

- Your driving history (eg tickets)

- Strong climate change

- The accident around you

- The price of cars around you.

Root Insurance Reviews also adjusts premiums based on the accuracy of its own cost projections over a given six-month period. Fees increase when premium income is less than the cost of paying claims; Premium rates fall when premium income exceeds the cost of paying claims.

Some customers have complained about skyrocketing rates after the initial term of the policy. Buyers should therefore be aware that the fee offered to them upon completion of the test drive can increase significantly even if there is no change on your part as a driver.

Buyers should also note that Root Insurance Reviews tracks their data after the test drive. The company says it will stop using the score to evaluate you after the test drive. The company’s privacy policy means that you can change your data sharing permissions even after the trial period.

Car Insurance Claims

After an accident, Root policyholders can use the app to report damage and request roadside assistance. Provide as much detail and photos as you can. The tribe will contact you to review the complaint and determine the next steps.

For direct contact with a root complaints specialist, call him during business hours at 866-980-9431. You can also submit an auto insurance claim on the company’s website or by calling the company’s 24/7 Root Insurance Phone Number, but you probably won’t be able to access a Root adjuster only during normal working hours.

Car Coverage

There are relatively few Root auto insurance policies, so drivers who need specialist coverage may want to look elsewhere.

Root differentiates itself from leading national insurers by including roadside assistance in all its insurance policies. Roadside assistance is usually an additional charge for most companies. Over a six-month contract period, Root covers up to three services (e.g. flat tire or starter), each costing less than $100.

Root also sets itself apart from other insurers with its ride-refund option. Many companies offer a rental reimbursement supplement that covers the cost of a rental car while your own car is in the shop to receive repairs for an insured accident. In this situation, Root allows drivers to use this rate for ride-sharing instead of a rental car if they wish.

Policyholders with Root, however, are limited in the coverage options they can choose from. Many other auto insurance companies offer coverage like gap insurance and ride-sharing insurance for drivers, Root does not. In addition to the Basic Collision Damage Waiver, Root policyholders can only add Rental Car Reimbursement coverage to their policy.

While many insurance companies offer uninsured property damage coverage to drivers in every state they operate in, Root Insurance Reviews offers this coverage only in certain states.

SR-22 coverage documentation can be obtained from Root Insurance Stock by drivers who require it. In many states, drivers who have lost their license are required to present an SR-22 document proving that the driver has adequate liability insurance before they can recover their license. Documents such as the SR-22 make reference to an insurance policy referred to as “SR-22 insurance”. Root Insurance Reviews policyholders can apply for an SR-22 in the application.

How Satisfied Are Roots Assurance Customers?

Researching claims about an insurance company can help drivers know if the insurance company is right for them.

Consumer complaints about insurers are collected by the National Association of Insurance Commissioners (NAIC). It sets the average number of complaints in the industry at 1.0, which means that a company with a score of 0.5 has half the number of complaints on average. According to the NAIC, Root Insurance Stock score is 3.98, which means the company receives nearly four times the number of complaints it receives from customers.

About Basic Insurance

Root Insurance Stock is the first fully mobile licensed insurer in the country. We are based on the principle that car insurance rates should be based primarily on driving behavior and not on demographics. Using mobile technology and data science, Root Insurance Stock provides good drivers with fair, personalized fares through an easy-to-use app.

The Root Insurance Customer Service is headquartered in Columbus, Ohio, with renter policies available throughout the state of Arkansas, Missouri, Ohio, Georgia, Kentucky, Nevada, Tennessee, and Utah. Currently, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Georgia, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maryland, Mississippi, Missouri, Montana, Nebraska, North Dakota, Ohio, Oklahoma, Oregon, South Carolina, Tennessee, Texas, Utah, Virginia, and West Virginia currently offer auto coverage.

Customer Service Information

If you are having difficulties accessing your Root Insurance login account, please contact the Root Insurance support team. They will help you solve your problem and answer your questions about how to connect to your Root Insurance Customer Service account. Below is the Root Insurance Phone Number.

Customer Service Root Insurance Phone Number:

- Request new roadside assistance: 844 271 4357

- To confirm someone’s employment with Root Insurance Phone Number: 1-800-367-5690.

- For auto insurance claims:

- New Claims: 866-980-9431

- Existing Claims: 866-489-1985

- For Renter’s Insurance Claims:

- New Claims Root Insurance Phone Number: 866-980-9431

- Existing Claims Root Insurance Phone Number: 866-489-1985

- For Root Home Claims: All Claims (New and Existing): 844-208-0665

- Opening Time: 9:30 a.m. to 5 p.m., 7 days a week, Easter period

- Office Address: 80 E Rich Street, Suite 500, Columbus, OH 43215

- Official website: www.joinroot.com

Bottom Line

That’s all about Join Root Insurance at www.joinroot.com. We share all about the Root Car Insurance Login Portal, for example. We hope this article is useful to you. If you still have questions about how to connect to Seguro Root Insurance Customer Service, please contact us by comment.

Easy Referral Bonus Money – Very easy to complete. The Root Insurance Customer Service can also save some of what I’ve read. Unfortunately, it’s not currently available in my region; otherwise, I’d like to try it.

I heard about Root Insurance a few years ago and how they were trying to revolutionize the auto insurance market with their business model. Root was a small startup at the time, but it seems to have grown a lot and the company is now public.